VAT invoices

Only VAT-registered businesses can issue VAT invoices and you must:• issue and keep valid invoices - these can be paper or electronic

• keep copies of all the sales invoices you issue even if you cancel them or produce one by mistake

• keep all purchase invoices for items you buy

Valid invoices

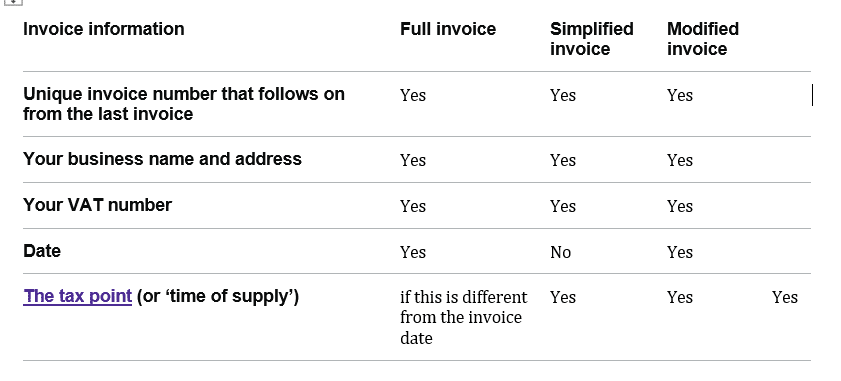

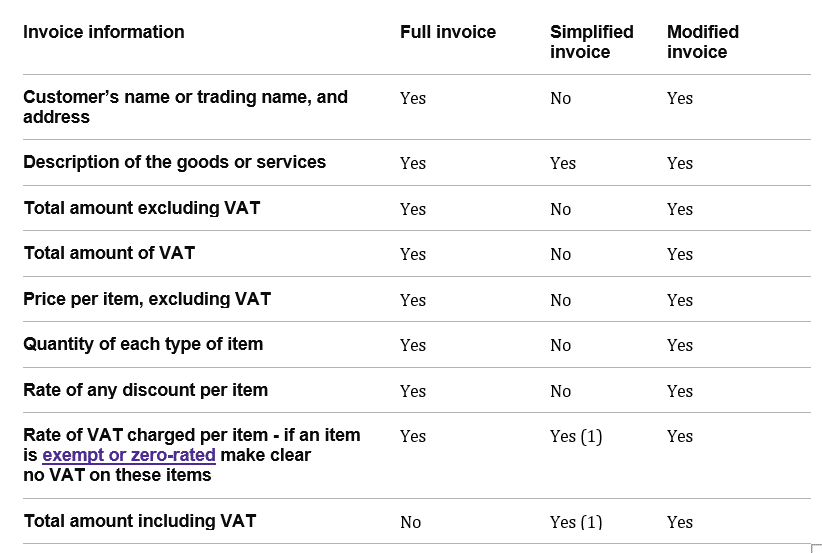

You’ll use a full VAT invoice for most transactions. You can use:• a modified invoice for retail supplies over £250

• a simplified invoice for retail supplies under £250 - and for other supplies from 1 January 2013

You cannot reclaim VAT using an invalid invoice, pro-forma invoice, statement or delivery note.

Include the following on your invoice, depending on which type you use.

(1) If items are charged at different VAT rates, then show this for each.

VAT records

Records you must keep include:• copies of all invoices you issue

• all invoices you receive (originals or electronic copies)

• self-billing agreements - this is where the customer prepares the invoice

• name, address and VAT number of any self-billing suppliers

• debit or credit notes

• import and export records

• records of items you cannot reclaim VAT on - for example business entertainment

• records of any goods you give away or take from stock for your private use

• records of all the zero-rated, reduced or VAT exempt items you buy or sell

• a VAT account

You must also keep general business records such as bank statements, cash books, cheque stubs, paying-in slips and till rolls. If you use the Cash Accounting Scheme you must use these records to match them against your payment records and receipts. If you supply digital services in the EU and use VAT MOSS, you must keep additional records. HM Revenue and Customs (HMRC) may check your records to make sure you’re paying the right amount of tax.