You could be closer to saving your deposit than you think

1Help to Buy: ISA For first-time buyers anywhere in the UK

How does it work?

If you are saving to buy your first home, save money into a Help to Buy: ISA and the Government will boost your savings by 25%. So, for every £200 you save, receive a government bonus of £50. The maximum government bonus you can receive is £3,000.

Open: the Help to Buy: ISA is available from a range of banks, building societies and credit unions.

The accounts are available to each first time buyer, not each household. This means that if you are planning to buy with your partner, for example, you could receive a government bonus of up to £6,000 towards your first home.

Save: save up to £200 a month into your Help to Buy: ISA. To kickstart your account, in your first month, you can deposit a lump sum of up to £1,200.

The minimum government bonus is £400, meaning that you need to have saved at least £1,600 into your Help to Buy: ISA before you can claim your bonus. The maximum government bonus you can receive is £3,000 – to receive that, you need to have saved £12,000.

Receive bonus: when you are close to buying your first home, you will need to instruct your solicitor or conveyancer to apply for your government bonus. Once they receive the government bonus, it will be added to the money you are putting towards your first home. The bonus must be included with the funds consolidated at the completion of the property transaction. The bonus cannot be used for the deposit due at the exchange of contracts, to pay for solicitor’s, estate agent’s fees or any other indirect costs associated with buying a home.

2Shared Ownership For owning a share of a home

Shared Ownership

If you can’t quite afford the mortgage on 100% of a home, Help to Buy: Shared Ownership offers you the chance to buy a share of your home (between 25% and 75% of the home’s value) and pay rent on the remaining share. Later on, you could buy bigger shares when you can afford to.

You could buy a home through Help to Buy: Shared Ownership in England if:

your household earns £80,000 a year or less outside London, or your household earns £90,000 a year or less in London you are a first-time buyer, you used to own a home but can’t afford to buy one now or are an existing shared owner looking to move.

With Help to Buy: Shared Ownership you can buy a newly built home or an existing one through resale programmes from housing associations. You’ll need to take out a mortgage to pay for your share of the home’s purchase price, or fund this through your savings. Shared Ownership properties are always leasehold.

Only military personnel will be given priority over other groups through government funded shared ownership schemes. However, councils with their own shared ownership home-building programmes may have some priority groups, based on local housing needs.

People with disabilities

Home Ownership for People with Long-Term Disabilities (HOLD) can help you buy any home that’s for sale on a Shared Ownership basis if you have a long-term disability.You can only apply for HOLD if the properties available through the other home ownership schemes don’t meet your needs, eg you need a ground-floor property.

Older people

You can get help from another home ownership scheme called Older People’s Shared Ownership if you’re aged 55 or over.It works in the same way as the general Shared Ownership scheme, but you can only buy up to 75% of your home. Once you own 75% you won’t have to pay rent on the remaining share.

Applying for a Help to Buy: Shared Ownership scheme

To buy a home through a Help to Buy: Shared Ownership scheme contact the Help to Buy agent in the area you want to live.3Equity Loan For brand new homes in England

How does it work?

With a Help to Buy: Equity Loan the Government lends you up to 20% of the cost of your newly built home, so you’ll only need a 5% cash deposit and a 75% mortgage to make up the rest.

You won’t be charged loan fees on the 20% loan for the first five years of owning your home.

Help to Buy: Equity Loan scheme Example

If the home in the example above sold for £210,000, you’d get £168,000 (80%, from your mortgage and the cash deposit) and you’d pay back £42,000 on the loan (20%). You’d need to pay off your mortgage with your share of the money.

For more information (including advice on fees and paying back your loan) please download our Help to Buy buyers’ guide.

London Help to Buy

To reflect the current property prices in London, from February 2016 the Government is increasing the upper limit for the equity loan it gives new home-buyers within Greater London from 20% to 40%.If you are looking to buy a new home in a London borough, find out more about London Help to Buy.

4London Help to Buy For brand new homes in London

London Help to Buy

To reflect the current property prices in London, from 1 February 2016 the government increased the Help to Buy: Equity Loan scheme’s upper loan limit from 20% to 40% for buyers in all London boroughs.How does it work?

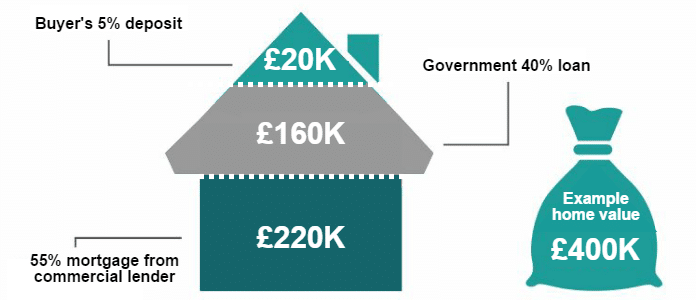

The London Help to Buy scheme could help you realise the dream of owning your own home in the capital. When you put down as little as a 5% deposit on a newly built home, you can get a government equity loan – for up to 40% of the purchase price.London Help to Buy: example costs

If the home in the example above sold for £420,000, you would get £252,000 (60%, from your mortgage and the cash deposit) and you would pay back £168,000 on the loan (40%). You would need to pay off your mortgage with your share of the money.You won’t be charged loan fees on the 40% loan for the first five years of owning your home.

Aldermore, Bank of Scotland, Barclays, Halifax, Leeds, Lloyds, Nationwide, NatWest, Newcastle, Royal Bank of Scotland, Santander, Teachers and TSB offer London Help to Buy.

Who is eligible?

London Help to Buy Equity Loans are available to first time buyers as well as homeowners looking to move. The home you want to buy must be newly built with a price tag of up to £600,000.You won’t be able to sublet this home or enter a part exchange deal on your old home. You must not own any other property at the time you buy your new home with London Help to Buy.

How to apply

The London Help to Buy Equity Loan scheme is run by a government-appointed Help to Buy agent. They can guide you through your purchase, from providing general information about the scheme to dealing with your application.To find out more about applying for an equity loan in London visit the Help to Buy agent for the Midlands and London or call 03333 214 044.

Alternatively, you can get more help and advice from the Money Advice Service and other useful contacts.

Other London schemes

The Help to Buy agent for London provides the administration of the Help to Buy: Equity Loan scheme only. They cannot guide potential purchasers on wider housing options.To explore all other low-cost home ownership options in Greater London please visit the Mayor’s Homes for Londoners website.

Alternatively you can explore many national housing schemes that could help you buy in the capital on the Government’s Own Your Home website.

5Own Your Home For all government-backed schemes

If you can’t find the scheme you need on this website you still have options available to help you buy a home. Please visit ownyourhome.gov.uk and answer a few quick questions about yourself to find out which government-backed schemes could help you open the door to home ownership.